Experienced Investors Saved $700 a Month with Loan Restructuring

Refinancing Case Study- Self Employed Investors

Client at a glance

Executive Summary

Mortgage Corp helped a self employed couple save approx. $700 a month through refinancing their home loan and two investment loans. We’ve also restructured their loans so they will be able to afford another investment in the next 2 years

Overview

Client: Jason and Rebecca, clients of Mortgage Corp since 2015

Marital status: married with no children

Income: combined income of $190,000

Occupation: Self Employed IT Professionals

Suburb of home: Doncaster, VIC 3108

Objective: Get a better interest rate on their loans and purchase another property close to the city in the next 2 years

Results: Reduced interest rate by more than 1% saving around $700 per month in repayments. Restructured their loans to enable them to purchase another investment in the next 2 years

Background

Jason and Rebecca, experienced property investors, both self-employed with a combined income of just over $190,000. They currently own a beautiful home in the eastern suburb of Melbourne, Doncaster and have 2 investment properties earning approx. $40,000 rental income per year.

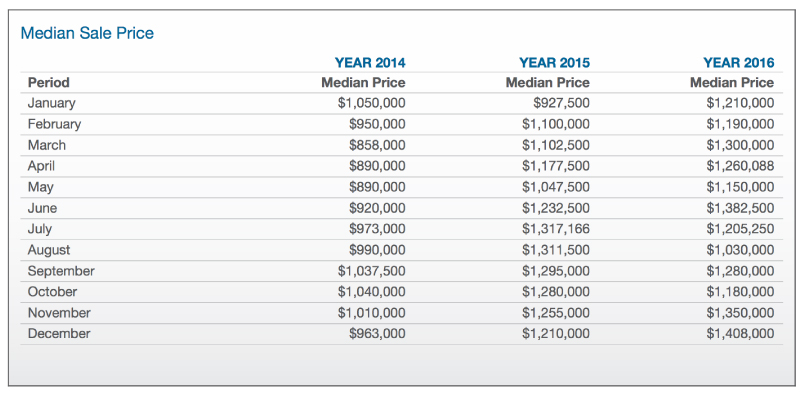

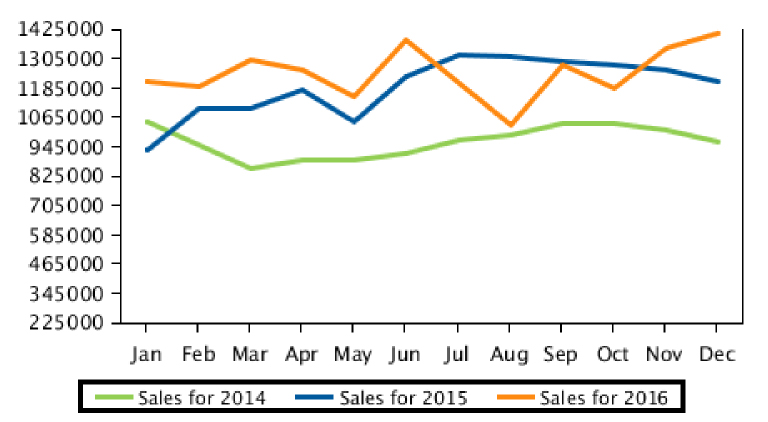

Households in Doncaster are primarily couples with children and are repaying between $1800 – $2400 per month on mortgage repayments. In general, people in Doncaster work in a Professional occupation. Currently the median sales price of houses in the area is 1,408,000.

Jason and Rebecca are both financially savvy and have got quite a large amount of savings. They enjoy a great lifestyle travelling and dining out often. They want to buy another home near the city so they can enjoy the fun city lifestyle.

Sources: RP Data 2017

Objectives

- Get a better interest rate on their loans

- Buy another property close to the city in the next 2 years

In our loan strategy session, we discussed their goals and lifestyle and they mentioned their immediate goal was to buy another property in an inner suburb in the next couple of years so they can live closer to the city and enjoy all the entertainment and convenience an inner suburb has to offer.

Challenges

- High Interest Rate– They were paying almost 5% interest rate on their 3 loans, which was at least 1% higher than the average home loans we got for our clients at the time.

- No loan structure. The investment loans and home loan are all mixed up, which costs them money

- They hadn’t reviewed their 3 loans for 3 years. They took a set and forget approach and missed out on some great investment opportunities

Solutions:

- Restructure Loans to Save Time/Money

Jason and Rebecca had 3 houses, 1 home and 2 investment properties. They had previously used the equity from home loan to purchase an investment.

Out of their $800,000 home loan, $400,000 was supposed to be for one of their investments. Each year, their accountant had to spend more time to work out their interest and everything else based on their home loan statements, which of course cost them more money.

We did one little thing that fixed the high accounting fee problem. We showed them how to split the loans, the idea was to differentiate the investment loans from the home loan.

Now their investment loans are separated from their home loan and they get separate statements for each loan. Then they don’t have to pay for the extra time the accountant takes to work out the tax deduction for their investment loans.

More importantly, we restructured their loans in a way so they are now able to leverage their investment equity to purchase another property.

- Restructure Loans To Buy New Investments

Jason and Rebecca were interested in buying another investment property. When they went to CBA where they had all of their loans with and wanted to borrow more money but they were told they couldn’t afford it.

When we checked their financials and we found out they actually could afford to buy another investment if they wanted to.

The bank’s loan officer only went with Jason and Rebecca’s taxable income and didn’t bother to check their financials thoroughly enough.

We were able to identify the business expenses and add them back as income to increase their borrowing power.

- Apply For Discounted Interest Rate On All Loans

Jason and Rebecca had their loans with CBA which they do everyday banking with, and they hadn’t reviewed them for 3 years. They were paying 1% higher on interest rate than most our clients at that time.

Thanks to our premium broker status, we were able to apply for discounted interest rate below 4% at the time for all their investment loans and home loan, even though most banks are charging higher interest rate on investment loans at the time, generally above 4%.

Results

- Reduced interest rate by more than 1% saving around $700 per month in repayments

- Proper loan structure with opportunity to purchase another investment

- Clear statements for different loans saving yearly accounting cost

- Schedule a time for annual review so we can re-examine their goals, lifestyle, loan structure and interest rate

Note: for privacy reasons, names used in this case study are not real client names.

For real Mortgage Corp customer reviews, visit

mortcorpdev.mortgagecorp.com.au/testimonials/ or

www.facebook.com/pg/mortgagecorp/reviews/

What’s Next?

Keep reading Getting A Self Employed Loan Isn’t As Hard As You Think or Review And Restructure Your Loan(s) for Long Term Investment Success