Strategically Structured Bridging Finance Gave This Family An Extra $100K Profit

Bridging Finance Case Study

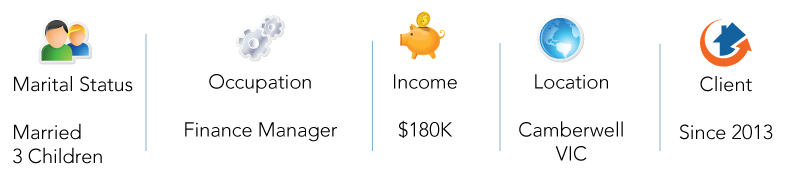

Client At A Glance

Executive Summary

Mortgage Corp helped a family strategically structure their loans to allow them to comfortably purchase a larger home whilst maximising the sale price of their existing home. The right loan structure enabled the client to buy a bigger home in a nearby suburb without rushing to sell their existing house at an undesirable price. They were able to live in their existing home and renovate it slightly to sell it for a great price until after they had moved into the new house.

Client Overview

Client: David, a high income earner.

Marital status: married with 3 kids (all under 10 years old)

Income: Single high income ($180K per annum)

Home value: approx. $1.2 million

Occupation: Finance Manager

Suburb of previous house: Camberwell, 3124 Victoria

Suburb of current (new) house: Balwyn, 3103 Victoria

Objective: upgrade to a bigger home near Camberwell to accommodate a growing family

Results: made an extra $100k profit on the old home, bought a much larger new home at a slightly higher monthly repayment than they originally paid, and all stress free

Client of Mortgage Corp since 2013

Background

David was a single income high earner of about $180,000 per year supporting a young family with three children under the age of 10. The family owned a home in the inner eastern suburb of Camberwell worth approximately $1.2-1.3 million. David wanted to move to a bigger home so the family of 5 could have more room and live more comfortably.

Because Camberwell was a well sought-after area, with decent schools and transport, the price of a larger home in the area exceeded what David was willing to spend. Our property reports showed that the cheapest house sale in Camberwell in 2016 was $1,050,000 while the most expensive house was $2,259,000.

In order to upgrade his family of 5 to a nicer house in a similar suburb, we suggested David look at Balwyn, a neighbouring suburb not too far from Camberwell where David also has friends and family. Based on the latest property reports and sales we had, Balwyn seemed to have similar growth and figures to Camberwell but the property price was relatively lower. Balwyn’s overall house values had risen quite strongly in the last few years – 16.2% in 2014 and 25.7% in 2015.

Notes: We’ve also noticed recently that many of our clients with homes in suburbs like Camberwell and Balwyn are looking at investment lending options using equity due to the sharp growth those areas have seen over the last few years. Clients in those areas who haven’t reviewed their loans in a while are also surprised when we are able to find them better rates and offers with house prices between $1.3 to 3 million. These areas have a high lending amount but low ratio to value loans in most cases. Therefore they are eligible for some very surprising discounts not normally advertised. Property investors from these areas don’t seem to be using the different options for debt reduction to their advantage with the big one being an offset account. When we discuss the purpose and use of the offset and benefits, it helps our clients quickly grasp this concept and start saving interest and utilise the benefits immediately

Objectives

- Finance a family home of his dreams

- Maximise the sale price of his existing home

- Make the moving process as stress-free as possible

David’s Options:

Mortgage Corp sat down with David and helped him evaluate the main options available to him to achieve his and his family’s objectives. Either he could:

- First sell his house and buy another one with the money he received;

- Borrow the full value of the new home first before selling his existing house and paying it down; or

- Set up bridging finance.

Challenges

The main problems with Option 1 were:

- Disruption to family life – if David had chosen to sell his home first, he would then have to worry about how long his family would live with his in-laws for, and his kids’ school arrangements whilst he searched for a new home.

- Feeling rushed to settle for a less-than-perfect family home – because he would need the funds from the sale of his home to buy the new property, David might miss out on a property he really liked if the settlement date was before the sale date. Likewise he might feel tempted to buy a house that was less than perfect in order to get the right settlement date.

- Achieving a lower sale price on his existing home – because of a desire not to disrupt his family, he might miss out on a great buyer if he insisted on renting the house back from the new buyer for a month or two whilst they went out and looked for another house.

The main problems with Option 2 were:

- Maxing out his borrowing power – if David had chosen to take on a new mortgage to buy the larger house whilst still living in his existing home, he would have had to borrow $1.6million plus the mortgage on his existing property – that is a lot of debt and interest, even for a high income earner and not all banks are willing to lend that much.

- Feeling pressure to sell the existing home without maximising its sale price – taking on the extra debt would have made David feel rushed into selling his existing home without taking the time to improve its value.

Solution

Thanks to our experience, we were able to show David how option 3 could be the best solution for his situation. We showed David how to structure his loan correctly, so he was able to go and purchase a $1.5 million property without needing to put any extra money down, move into that property, then sell his current property and close off the bridging facility.

This meant he didn’t have to worry about selling his place and where his family was going to live as they had already moved into their new home.

In fact, because he was able to move out of his old house without the pressure of a massive loan to pay off, he was able to take the time to make some minor renovations such as repainting, cleaning and landscaping whilst there was nobody living there. He ended up being able to sell his home for $1.3 million, when the bank had only valued it between $1.1 and 1.2 million.

We were able to show the bank that instead of needing David to borrow $2.2 million+, by presenting the loan structure and taking into account the expected sale price of his existing home, he could enter into a bridging finance arrangement without having to borrow an excessive amount.

The Bridging Loan Solution Mortgage Corp Negotiated

Sale amount of existing home: $1.3 million

Purchase amount of his new home: $1.5 million

Total cost including Stamp duty and other fees: $1,587,000

Interest was added to the loan amount during the bridging process and David didn’t have to pay monthly instalments whilst trying to sell. This enabled David to settle on the new purchase then tidy up his existing house when empty and sell it for a premium with no stress.

Results

- Happily moved his family into a wonderful new home with a manageable mortgage and without having to worry about aligning the settlement date with the sale of his existing home

- Had ample time to sell the house, resulting in an extra $100k+ on the sale price

- No stress of temporary accommodation whilst searching for a new home

Note: for privacy reasons, names used in this case study are not real client names.

For real Mortgage Corp customer reviews, visit

mortcorpdev.mortgagecorp.com.au/testimonials/ or

www.facebook.com/pg/mortgagecorp/reviews/

What’s Next?

Keep reading Bridging Loans – What You Need to Know

Request A Free Loan Strategy Session